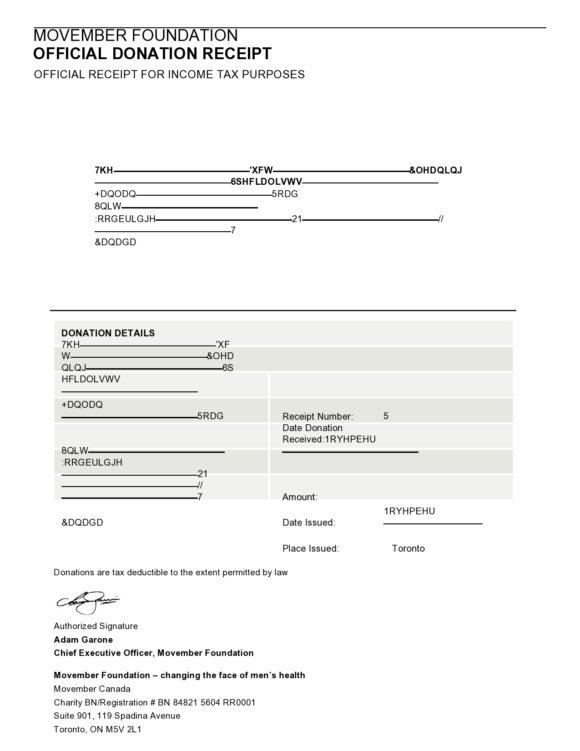

Sample Donation Receipt

To receive a tax deduction the donor. Donation Receipt Template 0.

Free Donation Receipt Templates Samples Word Pdf Eforms

Charitable donation receipts are imperative documents especially for charity institutions because donations are non-deductible for the donors.

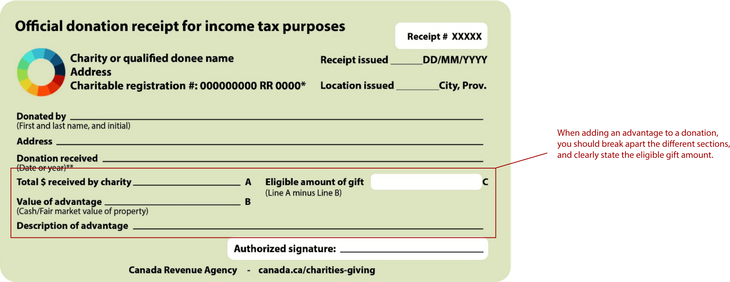

. The IRS is very particular as to what. Who is WRITING this Receipt. A donor gives a charity a house valued at 100000.

The amount of the advantage 20000 must be subtracted from the amount of the gift the 100000 value of the house. You can make donation scripts digitally or use receipt templates available online which are printable too. Often a goodwill donation receipt is presented as a letter or an email which is given or sent to the benefactor after the donation has been received.

Updated June 03 2022. There is no IRS penalty to the charity. For example a business may choose to donate computers to a school and declare that donation as a tax deduction.

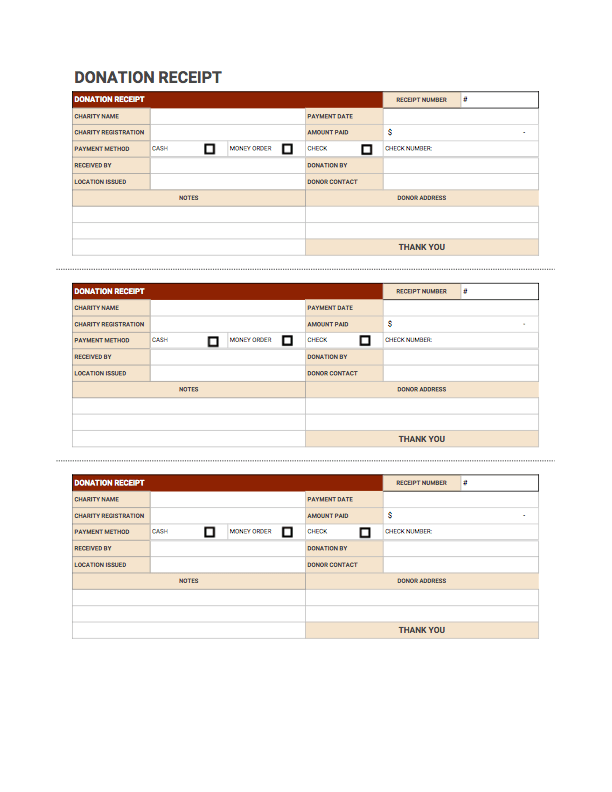

The 4 Rules for Great Donation Receipts. 501 c 3 charity donation receipt is written by the charity organization upon receiving contributions worth 250 and above. A donation receipt template should comply with particular requirements when it comes to the information it contains.

The Leading Online Publisher of National and State-specific Legal Documents. First you need to make sure the donor has a record of their donation that they can use at tax time. Ad Purple Heart Tax Receipt More Fillable Forms Register and Subscribe Now.

Donation receipts are also required when one individual donation adds up to 250 or more. Remember your non-profit receipts have two primary purposes. Ad Stay organized and look professional with our online tool.

An in-kind donation receipt is used for the donation of any type of property or goods that has an undistinguished value such as clothing furniture appliances or related items. Our site shows when receipts are sent viewed by your customer and accepted or declined. It is a good practice.

This is a letter thanking the person or the organization and at the same time acknowledging the person that you have received the needful. A donation receipt is of great significance if the donor wants to. 1 PDF editor e-sign platform data collection form builder solution in a single app.

Ad Download Or Email ACS Forms More Fillable Forms Register and Subscribe Now. Moreover you can only issue a donation receipt under the name of the individual who made the donation. A donation can be in the form of cash or property.

The Donation Receipt Seinfeld reference is simple but gave me a chuckle. Is this Receipt for a Single Donation. A PersonCompany making a Donation An Organization receiving a Donation.

Posted by 10 months ago. Donation receipt sample letter is the acknowledgment letter for receiving the amount of donation that you asked for either in the form of money or in kind. A donation receipt is always necessary if the donor requests one no matter the amount or value.

Three sets of IRS tax rules govern how a 501 c 3 organization must acknowledge payments from donors. You should include this information to make your document useful and official. An ideal donation script should include definite information about the amount of donation and what the donor received in return.

Second you want to use your receipt as an additional donor touch that helps build a stronger relationship between you and your donor. A 501c3 Donation Receipt is a written document stating or acknowledging that a donation has been made and received from one party to another party an individual or an entitynon-profit organization. Finally if the individual who made a donation and received goods and or services in exchange for any donation over 75.

A donation receipt can be in the form of a letter card or email. To place it simply donation receipts are concrete proof or evidence that a benefactor had made a contribution whether in-kind or monetary to a group association or organization. So the eligible amount of the gift is 80000.

Donations primarily received are. The receipt is important to the donor who gives out cash vehicle or personal property and wishes to have a tax deduction on the donation. Sample 4 Non-cash gift with advantage.

Yes No this Receipt will be used as a Template for multiple donations. Hadnt seen this posted thought it was a great little reference to George Costanzas Human Fund gag that people. The Donation Receipt Seinfeld reference is simple but gave me a chuckle.

170 f 8 of the Internal Revenue Code disallows any contribution of 250 or more unless the taxpayer has contemporaneous written substantiation of the donation from the charitable recipient. 501c3 Donation Receipt Template. The charity gives the donor 20000 in return.

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Donation Receipt Free Downloadable Templates Invoice Simple

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Donation Receipt Template Pdf Templates Jotform

Free Donation Receipt Templates Silent Partner Software

Nonprofit Donation Receipts Everything You Need To Know

Free Donation Receipt Templates Silent Partner Software

Required Information On Tax Donation Receipts

5 Donation Receipt Templates Free To Use For Any Charitable Gift Lovetoknow